It’s a question that comes up repeatedly: can you write a check to yourself? Yes, you can do it. This article will walk you through the process and teach you the necessary skills. Stay tuned!

Yes, you can write a check to yourself. Writing a check to yourself is a legal way to transfer money safely. For the purpose of transferring money to a personal checking account or between accounts at the same bank, you can write a check to yourself.

You can transfer money electronically in addition to writing yourself a check using third-party services, ACH transfers, and wire transfers. In general, electronic transfers make it easier for you to get your money than writing a check.

But can you make a check payable to yourself? Writing a check to yourself seems like an easy way to transfer money from one bank to another or withdraw cash from your bank account. Please read on.

Table of Contents

Why Would You Write a Check to Yourself?

There are a few reasons you might need to write a check to yourself:

- Moving money between different banks– This frequently occurs if you are closing one account and moving the funds to another account. You might also need to write a check to yourself to cover the opening deposit if you choose to open a new account at a different bank.

- Withdrawing cash– A check is an excellent solution if you require cash but don’t have access to an ATM. If you need to withdraw more money than an ATM will let you, this is a good alternative as well. For instance, you might decide to write yourself a check that you can cash if you decide to buy a car from a private seller in cash.

- Paying yourself from your business– If you run a small business and are unable to transfer funds from your business checking account to your personal account, you may need to write yourself a check.

How to Write a Check to Yourself

Let’s discuss how to write a check to yourself now that you are aware it is possible.

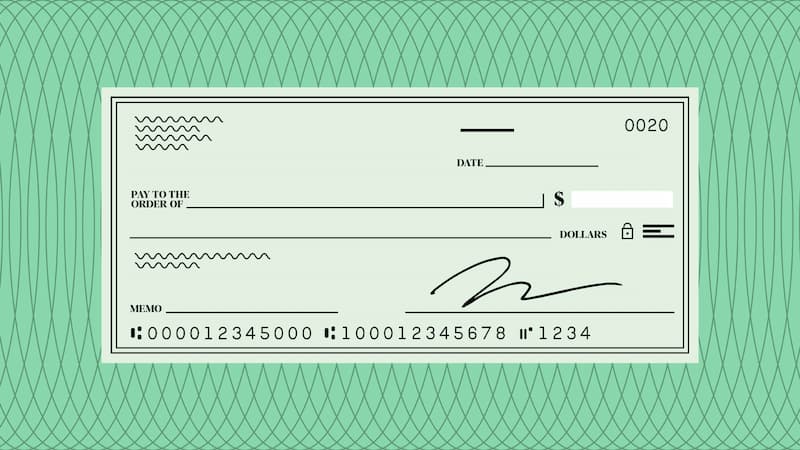

Fill Out the Date

Writing the date in the check’s upper right-hand corner is the first thing you must do.

Fill in the Payee

You’ll need to fill in who the check is being written out to, which in this case is you, just like when writing a check to someone else.

To accomplish this, simply write your full name in the “Pay to the Order Of” field.

Fill in the Dollar Amount

Following that, you must enter the check’s dollar amount twice. First, you’ll need to write out the numerical value of the check in the box adjacent to the “Pay to the order of” field.

Then, on the line immediately beneath that, you must write the dollar amount in plain English, making sure to include the cents written as a fraction.

For instance, if you want to write a check to yourself for $50.25, you would write “fifty and 25/100″ on the “dollars” line.

Fill Out the Memo Line

A check’s memo line is used to note the check’s purpose.

While this field isn’t required, it can be helpful to write something like “For deposit only” or “To transfer funds.” You can use the memo line to help you recall your motivation for writing the check in the future.

Sign the Check

The fifth and final step in writing a check to yourself is signing it on the signature line.

The recipient (in this case, yourself) cannot cash the check because it is invalid without your signature.

As you can see, writing a check to yourself is the same as writing a check to someone else. The fact that you will be the one receiving the money is the only difference.

Alternatives to Writing Yourself a Check

You don’t have to write a check to yourself to transfer funds or withdraw money from your bank account.

Here are a few alternatives you might want to consider if you’d prefer not to break out your checkbook:

Make An In-person Withdrawal

You can always go to your bank and make an ordinary withdrawal if you need to take money out of your checking account. If you require a substantial amount of money or don’t require immediate access to the money, this is a good choice.

Nowadays, standard withdrawals are not too difficult. The days of having to memorize your bank account number are long gone, though it is still a good idea to do so.)

The teller will typically only require your debit card, your pin, and your identification. They will then be able to assist you with whatever you need to do.

Go to the ATM

You can always go to your neighborhood bank and use the ATM if you don’t feel comfortable writing yourself a check. If you don’t need to withdraw more than a few hundred dollars, this is a great option.

Recall your PIN, but only just. You will have to use a standard withdrawal in the absence of that.

Zelle Yourself the Money

You could always Zelle yourself the money if you need to transfer funds from one bank to another, provided that both of your banks provide this service.

Without ever leaving the comfort of your home, you can transfer money using Zelle. In order to start a transfer, all you need to do is enter the recipient’s phone number or email address, which is usually just your own.

The only catch is that you need to give each Zelle account a different email address or phone number in order to link them together.

This means that in Zelle, you cannot associate the same phone number with two different bank accounts.

You must connect one bank account to your phone number and the other to your email address instead. You can also just use two different email addresses if that’s what you prefer to do.

You can transfer money from one bank to another using Zelle if you do that.

Intrabank Transfers

You should only use electronic means of transfer if you want to move money between different accounts at the same bank. Simply log into your online banking account, make a transfer, and in many cases it will be processed right away. The simplest way to complete this task is by far this.

ACH Transfers

Simply transferring money between financial institutions electronically is one of the most popular methods. ACH (Automated Clearing House) transfers are frequently used for this. You can link an external account to your bank account at many financial institutions in order to transfer money between them. Always ask about the possibility of doing this for free with both small and large financial institutions.

The main thing you should be aware of with this method is that it can occasionally take several days or even a week to link the accounts. In some cases, you can link the accounts instantly by logging into the external account, but in other cases, you may need to verify the accounts or make a test deposit to do so.

P2P Transfers

P2P transfers are a way some banks let you speed up the transfer process.

Chase Quick Pay with Zelle has won my heart. You can instantly transfer money using this method for no charge to a variety of banking institutions.

Although there are some restrictions on these transfers, they are quite lenient and even permit transfers between business accounts. The recipient will need to register with Zelle, but that only takes a few minutes, making this a very simple process.

Use a service like PayPal or VenMo as an alternative; it’s one of the simplest ways to transfer money between accounts. Setting up an account with these services is simple; all you need is an email address and the ability to link your routing and account numbers. You will be able to send and receive money between banks once you link your bank account.

Wire Transfers

You can also decide to use a wire transfer to transfer money to another account. However, there will frequently be charges for wire transfers. These costs can occasionally be quite high; for example, you might pay more than $20 to make a straightforward wire transfer. You can make free wire transfers with certain bank accounts, including high-end ones like Chase Private Client.

How Much Can You Write a Personal Check for Without Being Taxed?

As long as the money was not obtained through work of some sort, you are exempt from reporting personal check deposits to the IRS. Personal check deposits are tax-free as long as the funds are not associated with a business account or expense.

Personal checks, on the other hand, are taxable if you receive them as payment. As an illustration, if you are paid with personal checks while working as an independent contractor, this is taxable income. The same holds true if you work for an employer who pays you with personal checks.

What is the Largest Check a Financial Institution Will Cash?

The size of a check you can cash is not restricted by financial institutions, but they are required to report transactions over $10,000 to the IRS. You do not, however, need to report anything as an individual.

It’s unlikely that you would receive all of your money right away because the Federal Reserve does permit financial institutions to put a hold on sizable checks and deposits. Customers of financial institutions must have access to $200 of a check the following day.

Nevertheless, for a number of reasons, the institution might hold onto the remaining funds if your deposit is greater than $200. For example, if you recently opened a new account or if your bank or credit union believes the remaining balance can’t be collected, they may place a “deposit hold” or “check hold” on the check you provided.

How Much Money Can You Deposit in a Bank Or Credit Union Without Getting Reported?

$10,000 or more in cash deposits must be reported to the IRS. You must finish and submit Form 8300 within 15 days of making a deposit of this amount or more. You must list the source of the cash, the method of payment, and a justification for receiving it on the form.

Cash is defined by the IRS as cash, bank drafts, cashier’s checks, and money orders. Personal and business checks are exempt from reporting requirements.

Read about How to Buy a House at Auction Without Cash?

Can I Write a Check to Myself With No Money in My Account?

Without sufficient funds in your bank account, it is against the law to write a check to yourself. You must make sure the funds specified on the check are available in your account before you write a check.

The check will eventually bounce even if the receiving institution accepts the bad check and deposits the requested funds into your account. This practice is “check kiting” and is a form of fraud that can result in serious legal trouble. Try to immediately voide the check if you don’t think you have enough funds in your account to cover the amount you wrote it for.

FAQs

Can you make out a check for yourself?

There are a few things to take into account when writing a check to yourself, but it is legal to do so.

Can I cash a check made out to me?

Yes, you can cash a check made out to yourself, but make extra sure you have the money to do so. You risk being accused of a crime if you don’t.

Is It Illegal to Write a Check to Your Name?

You can write a check in your name without breaking any federal laws. In light of this, it is legal and not illegal to write a check in your name.

Is There a Maximum Amount You Can Write a Check?

You can write a check for any amount, without restrictions. The amount you can send or withdraw from your account at one time may be restricted by some banks.

Why Writing a Check to Cash is a Bad Idea?

Writing a check that you intend to cash is a bad idea because if the check is lost, the person who finds it can cash it without being accused of theft.

What is Check Kiting?

Writing checks on accounts with insufficient funds in order to take advantage of the float period is known as check to kite fraud.

Can I Write a Check to Myself With No Money in My Account?

The short answer is no, you cannot write a check to yourself if there is no money in your account. There must be funds in your account before you can write a check to yourself. In this case, the check will bounce and you risk being accused of bank fraud.

Final Word

In conclusion, if you want to write a check to yourself when filling out a check, you can. However, as was already mentioned, there are numerous faster ways to move money between accounts that could save you a ton of time. Therefore, in order to make things simpler, I would continue researching electronic transfer methods.